Portfolio Management

Rethinking the "average" approach

Stocks are the bread and butter of many investment strategies. The problem is that most strategies deliver mediocre 6-7% returns by using simple tactics like “buy and hold”. Our active management approach aims to rethink the average approach and build a unique path to success by making strategic moves in the market to buy and sell when necessary. This means you can mitigate risks while also seizing opportunities when they arise.

Elevate your portfolio today!

Learn more about continuing your road to success. No consultation fee. No long-term commitment.

Power of timing vs the "Buy & Hold" strategy

The Confluent active investment process maximizes potential outcomes through strategic market timing. By actively managing an investment, the same time horizon can create different outcomes.

|

Stock Name (ticker)

|

Entry date

|

Exit date

|

Confluent active strategy

|

Buy & hold

|

|---|---|---|---|---|

|

Apple (AAPL)

|

7/31/24

|

10/31/24

|

+1.84%

|

-10.47%

|

|

Nvidia (NVDA)

|

1/31/23

|

10/31/24

|

+579.93%

|

+468.22%

|

|

Exxon Mobil (XOM)

|

4/30/24

|

6/30/24

|

-1.87%

|

-9.84%

|

This narrative and the performance figures are purely hypothetical and for illustration only. They come from model simulations, not actual client accounts. The example assumes perfect execution and ignores real-world factors (like fees, taxes, and market liquidity). Confluent Asset Management presents this story to educate – it is not a promise of future returns. All investing involves risk, including possible loss of principal. Past performance, even hypothetical, is no guarantee of future results. Always review the full disclosures and consider your personal financial situation before making any investment decisions.

Your Personal CFO

One advisor. One point of contact. Every answer.

From investments to estate planning, retirement income to insurance, you’ll never be handed off or left waiting. You’ll never talk to five different specialists to get one answer. With Confluent, a single, seasoned advisor oversees every detail of your financial life. You get streamlined advice, total accountability, and complete confidence.

No team, just one person who gets you

Experience private-client-level service with a single dedicated advisor managing your entire financial world.

Planning, investing, tax strategies, insurance, and more, all without ever repeating yourself. This is the white-glove experienced, redefined to suit you and your needs. When we work with you, we are tied to your success and not some overarching index or benchmark

Custom Stock Portfolios

Every person has their own investment goals and therefore they need a portfolio that aligns with those goals and not just another general “themed” portfolio. Our team works with every client to pick a portfolio of stocks that fits their exact financial needs.

We use our stock selection strategies as a foundation for this desired customization to ensure that we continuously keep your goals in our sights the entire way.

Our Stock Selection Strategies

Large Cap Growth

This strategy focuses on capital growth through investments primarily in common stocks, emphasizing companies poised for appreciation.

With the flexibility to allocate up to 100% of assets in domestic stocks, we target long-term capital appreciation by primarily investing in large cap equities.

Small Cap Growth

This strategy targets capital growth by investing primarily in common stocks, focusing on companies poised for appreciation.

With flexibility to allocate over 80% of assets in small-cap growth stocks.

Select Technology

This strategy emphasizes capital growth through investments primarily in common stocks, focusing on companies poised for appreciation.

With over 80% flexibility in allocating assets to technology stocks, our goal is long-term capital appreciation by primarily investing in high-growth technology stocks.

Keep learning more about leveling up your game!

We’ve a lot to share with you about stock selection. No cost or commitment. Make sure you don’t miss a thing

Why active management matters

We believe that sitting and waiting for success to come your way is not a strategy. Our advisors work with you to adapt and adjust strategies to navigate the markets in any situation.

This means taking advantage of positive market opportunities to outperform benchmarks, but also tactically shifting to minimize risks and negate potential losses when markets hit a downturn. With an active approach, you gain benefits like:

Capitalize on inefficiencies

Active investing strategies allow for a portfolio to find opportunities in markets when anomalies or uncertainty occurs. Compared to passive approaches that rely more on predictably in the markets, an active approach takes into account the unpredictable human elements of investing in the market.

Better risk management

Every investor knows that success is found by avoiding unnecessary risk as much as it is found in the maximization of opportunity. With most active management strategies, risk management is a priority. By navigating risky situations properly, downsides can be softened or avoided entirely in some situations.

Increased flexibility

Compared to a passive approach, active investment is designed to react quickly and effectively in any situation. This means that altering portfolio composition and allocation is not only easier but is a staple of the approach. Investors with an actively managed portfolio can set themselves up to better positioned particularly in highly volatile times.

Alpha maximization

Active management places an emphasis on maximizing alpha. alpha represents the outperformance of a strategy benchmark. Instead of simply keeping pace with a benchmark like a passive management, active management will give investors a leg up whenever possible to make sure their money grows faster than the average investment.

Your "simple" portfolio could secretly be sabotaging your wealth

Markets have changed. Interest rates, inflation, and global risk factors are more volatile than ever. Yet, many investors are still using outdated strategies. Investing in things like SPY and AGG may offer simplicity, but they don’t offer flexibility, risk management, or the potential for optimized growth on your timeline.

That is why our approach is built with the intention to be adaptable. We do this by using active strategies that adjust to the market, not just by investing in passive ETFs of Funds.

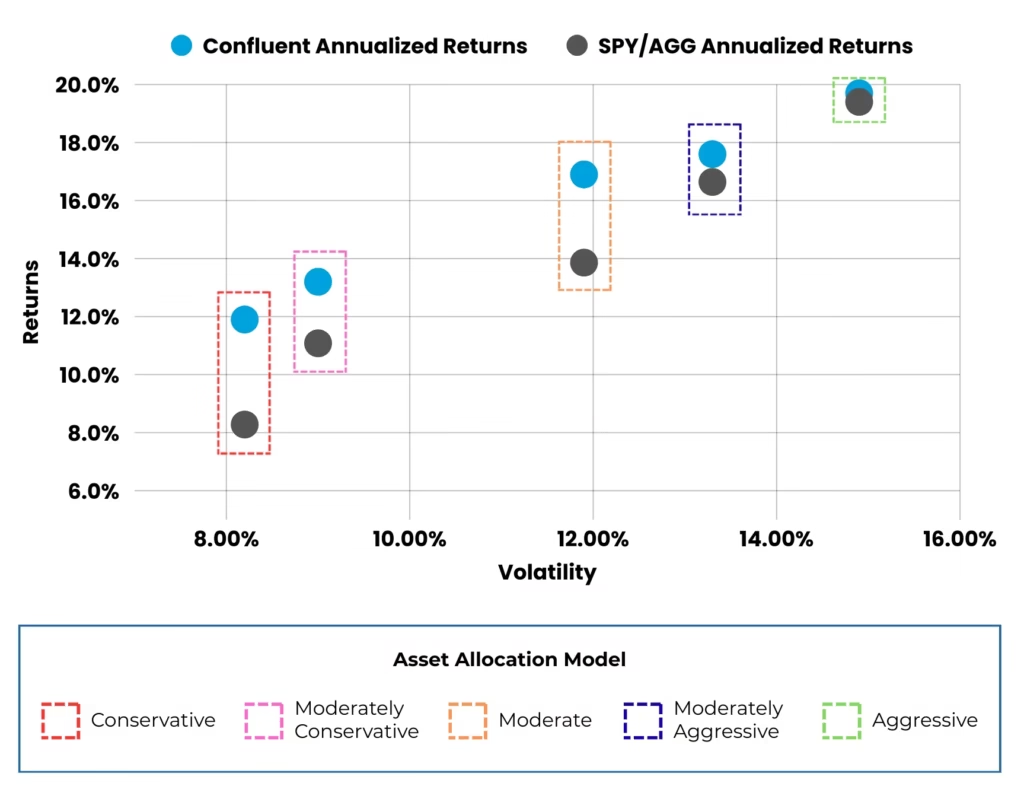

It's all about your asset allocation

If your retirement portfolio is built around the classic 60/40 allocation using SPY (S&P 500 ETF) and AGG (Aggregate Bond ETF), you might think you’re playing it safe.

But in today’s market, that “average” approach may be leaving serious money on the table while still leaving you open to some volatility. Based on back-tested data, this is what an “average” asset allocation would look like compared to the Confluent allocation.

Analysis period: 1/2/2024 - 7/16/2025*

Harness the power of active investment today

Speak with one of our advisors start crafting your actively managed strategy. No consultation fee. No long-term commitment.

Case Study

See how active management stacks up

When it comes to investing, most traditional strategies follow a familiar playbook: buy quality stocks, hold them long-term, and wait out market fluctuations. But what if you could do better? What if there was a smarter way to grow your wealth. Not by reacting, but by actively navigating the markets?

How we approach investment

Confluent offers tailored solutions across every stage of the investment cycle, aligning perfectly with client objectives. Whether focusing on income, growth, or risk management, our expert advisory team works closely with you to craft an ideal portfolio. Our diverse product portfolio includes distinctive options to support investors throughout wealth creation, accumulation, preservation, or distribution phases. Explore our comprehensive solutions for optimized investment strategies.

Risk Disclosure*

The views, information, or opinions expressed above are solely those of the author and do not necessarily represent those of any affiliated organizations, institutions, or entities. The article is meant for informational purposes only and should not be considered as professional investment advice. Past performance is not indicative of future results. The stock market is inherently risky, and investors may lose part or all of their investment. The author does not guarantee the accuracy, completeness, or timeliness of the information provided. Any reliance you place on such information is strictly at your own risk. This article contains forward-looking statements and projections that are based on current expectations, estimates, and projections about the stock market and the overall economic environment. These statements are not guarantees of future performance and involve certain risks and uncertainties that are difficult to predict. The author is not a licensed financial advisor, and this article should not be construed as a recommendation to buy, sell, or hold any investment or security. Before making any investment decisions, readers should consult with a qualified financial advisor to discuss their situation and risk tolerance. The author may hold positions in some of the stocks or financial instruments mentioned in this article. However, this does not influence the objectivity of the content presented. This article is protected by copyright laws and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of the author. By reading this article, you acknowledge that you have read and understood this disclaimer and agree to hold the author and any affiliated parties harmless from any losses, damages, or consequences resulting from the use of information contained within. The SPDR® S&P 500® ETF Trust (ticker: SPY) has been used as a representative proxy for U.S. equity market exposure, and the iShares Core U.S. Aggregate Bond ETF (ticker: AGG) has been used as a proxy for U.S. investment-grade fixed income exposure. These benchmarks are presented for illustrative purposes only and do not reflect the actual holdings or strategy of Confluent Asset Management.